Log Book For Tax Template . Using the log book method, a percentage of actual car expenses is. Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Key records you should keep to claim deductions. Web the logbook method is a good way to boost your tax refund. Here's how to use a logbook for car expenses. Use these resources and you’ll get the. In this post, we'll cover the ato's requirements for logbooks. Plus download free logbook template. To be valid for tax purposes, a log. Web what you’ll learn. Is the ato logbook method the right choice for me? Web the expense trackers and logbook templates on this page will save you lots of time and money! Web the log book method can be used to substantiate work related car expense claims.

from old.sermitsiaq.ag

Is the ato logbook method the right choice for me? Web the logbook method is a good way to boost your tax refund. To be valid for tax purposes, a log. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Web the expense trackers and logbook templates on this page will save you lots of time and money! Using the log book method, a percentage of actual car expenses is. Web the log book method can be used to substantiate work related car expense claims. Here's how to use a logbook for car expenses. Web what you’ll learn. Key records you should keep to claim deductions.

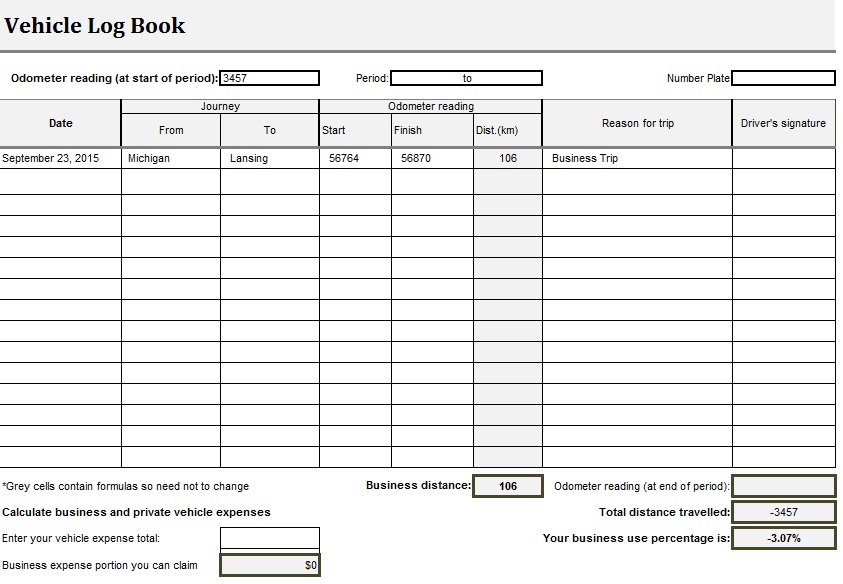

Vehicle Log Book Template

Log Book For Tax Template In this post, we'll cover the ato's requirements for logbooks. Key records you should keep to claim deductions. Is the ato logbook method the right choice for me? Using the log book method, a percentage of actual car expenses is. Plus download free logbook template. To be valid for tax purposes, a log. Web what you’ll learn. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Web the logbook method is a good way to boost your tax refund. Use these resources and you’ll get the. Web the log book method can be used to substantiate work related car expense claims. In this post, we'll cover the ato's requirements for logbooks. Here's how to use a logbook for car expenses. Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Web the expense trackers and logbook templates on this page will save you lots of time and money!

From www.bank2home.com

Log Book Templates 16 Free Printable Word Excel Pdf Formats Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Web the expense trackers and logbook templates on this page will save you lots of time and money! Is the ato logbook method the right choice for me? Key records you should keep to claim deductions. Here's how to use a logbook for car expenses. Use these resources. Log Book For Tax Template.

From shopfreshboutique.com

Printable Log Book Pages shop fresh Log Book For Tax Template To be valid for tax purposes, a log. Web what you’ll learn. Plus download free logbook template. Web the log book method can be used to substantiate work related car expense claims. In this post, we'll cover the ato's requirements for logbooks. Use these resources and you’ll get the. Here's how to use a logbook for car expenses. Key records. Log Book For Tax Template.

From www.slideserve.com

PPT PDF/READ/DOWNLOAD Tax Deduction Log Book Tax Return Organizer Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Web the logbook method is a good way to boost your tax refund. Key records you should keep to claim deductions. Plus download free logbook template. Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. To be. Log Book For Tax Template.

From www.alitax.com.au

Logbook ALITAX Log Book For Tax Template Web the expense trackers and logbook templates on this page will save you lots of time and money! Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Is the ato logbook method the right choice for me? Here's how to use a logbook for car expenses. Web log book records. Log Book For Tax Template.

From www.vrogue.co

Weekly Log Template Form Fill Out And Sign Printable vrogue.co Log Book For Tax Template In this post, we'll cover the ato's requirements for logbooks. Using the log book method, a percentage of actual car expenses is. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Web what you’ll learn. Is the ato logbook method the right choice for me? Web the expense trackers and. Log Book For Tax Template.

From www.creativefabrica.com

Tax Checklist Log Book KDP Interior Graphic by MB Studio · Creative Fabrica Log Book For Tax Template Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Key records you should keep to claim deductions. Using the log book method, a percentage of actual car expenses is. Is the ato logbook method the right choice for me? To be valid for tax purposes, a log. Here's how. Log Book For Tax Template.

From www.etsy.com

Tax Deduction Log Printable Tax Purchase Record Tax Etsy Log Book For Tax Template Use these resources and you’ll get the. Web the log book method can be used to substantiate work related car expense claims. Using the log book method, a percentage of actual car expenses is. Web what you’ll learn. Key records you should keep to claim deductions. Here's how to use a logbook for car expenses. Web a correct logbook will. Log Book For Tax Template.

From www.gofar.co

Vehicle Logbook Templates Streamline Your Mileage Tracking Log Book For Tax Template Here's how to use a logbook for car expenses. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Web what you’ll learn. Plus download free logbook template. Using the log book method, a percentage of actual car expenses is. Is the ato logbook method the right choice for me? Web. Log Book For Tax Template.

From www.alamy.com

Tax checklist log book KDP interior. Business tax information tracker Log Book For Tax Template Is the ato logbook method the right choice for me? Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Web the log book method can be used to substantiate work related car expense claims. Here's how to use a logbook for car expenses. Web a correct logbook will allow. Log Book For Tax Template.

From www.drivetax.com.au

Uber Logbook Example Rideshare DriveTax Australia Log Book For Tax Template Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. To be valid for tax purposes, a log. Web what you’ll learn. Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Web the log book method can be used to. Log Book For Tax Template.

From besttemplates123.blogspot.com

Best Templates Ultimate Guide to Making a Qualified ATO Logbook GOFAR Log Book For Tax Template Web log book records of business journeys are used to substantiate actual business percentage claims for work related car expenses. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Key records you should keep to claim deductions. Web the log book method can be used to substantiate work related car. Log Book For Tax Template.

From templates.rjuuc.edu.np

Fuel Log Template Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Key records you should keep to claim deductions. To be valid for tax purposes, a log. Plus download free logbook template. Web the expense trackers and logbook templates on this page will save you lots of time and money! Web the logbook method is a good way to. Log Book For Tax Template.

From www.pinterest.com

vehicle logbook templates gofar car expense log book template doc Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Key records you should keep to claim deductions. Is the ato logbook method the right choice for me? Web what you’ll learn. Here's how to use a logbook for. Log Book For Tax Template.

From www.pinterest.com.au

Vehicle Log Book Template for MS EXCEL Excel Templates Book Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Use these resources and you’ll get the. Web the log book method can be used to substantiate work related car expense claims. Web the logbook method is a good way to boost your tax refund. In this post, we'll cover the ato's requirements for logbooks. Is the ato. Log Book For Tax Template.

From old.sermitsiaq.ag

Log Book Templates Log Book For Tax Template Web what you’ll learn. Here's how to use a logbook for car expenses. Web the log book method can be used to substantiate work related car expense claims. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Plus download free logbook template. To be valid for tax purposes, a log.. Log Book For Tax Template.

From www.logtemplates.org

10+ Log Book Template Free Log Templates Log Book For Tax Template Use these resources and you’ll get the. Here's how to use a logbook for car expenses. Plus download free logbook template. Key records you should keep to claim deductions. Web the expense trackers and logbook templates on this page will save you lots of time and money! In this post, we'll cover the ato's requirements for logbooks. Web log book. Log Book For Tax Template.

From atotaxrates.info

Log Book Vehicle atotaxrates.info Log Book For Tax Template Here's how to use a logbook for car expenses. Key records you should keep to claim deductions. Web a correct logbook will allow you to claim additional deductions for motor vehicle expenses on your tax return. Using the log book method, a percentage of actual car expenses is. Web log book records of business journeys are used to substantiate actual. Log Book For Tax Template.

From taxtank.com.au

Free Vehicle Logbook For Compliant Tax Claims Log Book For Tax Template Using the log book method, a percentage of actual car expenses is. Web what you’ll learn. Key records you should keep to claim deductions. Use these resources and you’ll get the. Web the expense trackers and logbook templates on this page will save you lots of time and money! Here's how to use a logbook for car expenses. Web log. Log Book For Tax Template.